Trump Tariffs | Annual Impact | Net Worth | Personal Finance

Well, they are here. Just as advertised.

Voters voted for this—including both those who actively supported Trump and those who couldn’t be bothered to vote. What we wanted is here. The Trump Tariffs are here.

How much will the Trump Tariffs really impact each U.S. Household?

According to the nonpartisan nonprofit Tax Foundation, Trump's tariffs could add an extra $830 tax this year on the average US household. That's $69.17 per average household per month.

Why do I care?: This is money that I will no longer have to invest in my retirement. If that amount were invested in the stock market, it could grow to as high as $3,843.14 in four years. For me, that's real money.

Are the Trump Tariffs Ever Going to Go Away?

Not likely, and here’s why: The national debt currently stands at over $36 trillion. Why would the government dismiss a newly found source of revenue? Once a tax or tariff is introduced, it rarely disappears.

Can This "Grocery Tax" Be Avoided?

While the impact on an average household’s grocery bill can’t be completely avoided, it can be partially mitigated. Here are two strategies that I use:

1. Reduce Food Spoilage

The average household wastes up to 40% of the food it purchases. Cutting down on waste is one of the simplest ways to offset rising grocery costs. Here’s how I minimize food spoilage:

Check my refrigerator daily, preferably in the morning.

Assess which items need to be eaten soon and prioritize them before cooking new meals.

If an item is likely to be wasted, reflect on why I bought it and adjust my shopping habits accordingly.

2. Buy Groceries That Are Less Affected by Tariffs

The good news? The U.S. produces much of its own food and isn’t completely dependent on imports from Mexico, Canada, and China.

Here’s a basic continuum of selected food items, ranked from most to least affected by the tariffs:

So If I Buy the "Green Items," Will I Avoid Price Increases?

Not entirely.

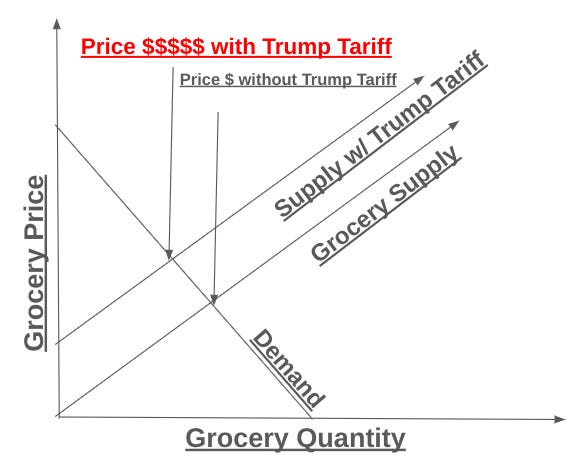

Even if the items you purchase aren’t directly impacted by tariffs, their prices can still increase. Why? Supply and demand. Consider the following chart:

As consumers shift away from high-tariff items (red zone) to alternatives (green zone), demand increases, and so do prices. This classic economic principle means that while you can minimize the impact, you can’t eliminate it completely.

This is why I doubt I can avoid the impact of the Trump Tariffs entirely, but the defensive measures provided in this Substack should help me do better than the average American household.

Finally, my Net Worth is...: $681,125. My Net Worth is holding steady.

Thanks for checking out my Substack. Please take a moment to subscribe so you get my latest posts.